For most insurance brokerages, processing applications for insurance is slow and clunky. It involves manually pulling and pushing information to and from various programs that often don’t integrate with their internal brokerage software. We knew there was a better way forward and created an application that reduced application processing time by up to 50%.

Project Overview

Challenges.

A time and cost-intensive application approval process

When a broker receives a call from a potential customer who is following up on an online quote, the long and tedious internal quote approval process begins.

This task usually involves a dozen different steps, from looking up the customer's quote in the brokerage’s internal system to identifying the lead source and then downloading the information from the dealership management software (like ezLeads).

The broker then has to look up the lead in a comparative rating systems software (like ARS), review the quote manually and then pull and review the customer’s driving reports. Then, they have to push the quote to their insurance agency management software (like Epic), update the customer’s profile and push that information to a carrier portal.

Only then can a broker finally read the customer the binding script before attaching the script to their record and then finally submitting the application.

This painful approach means long processing times for each application, which ends up costing insurance companies a ton of money.

We knew there must be a better way forward.

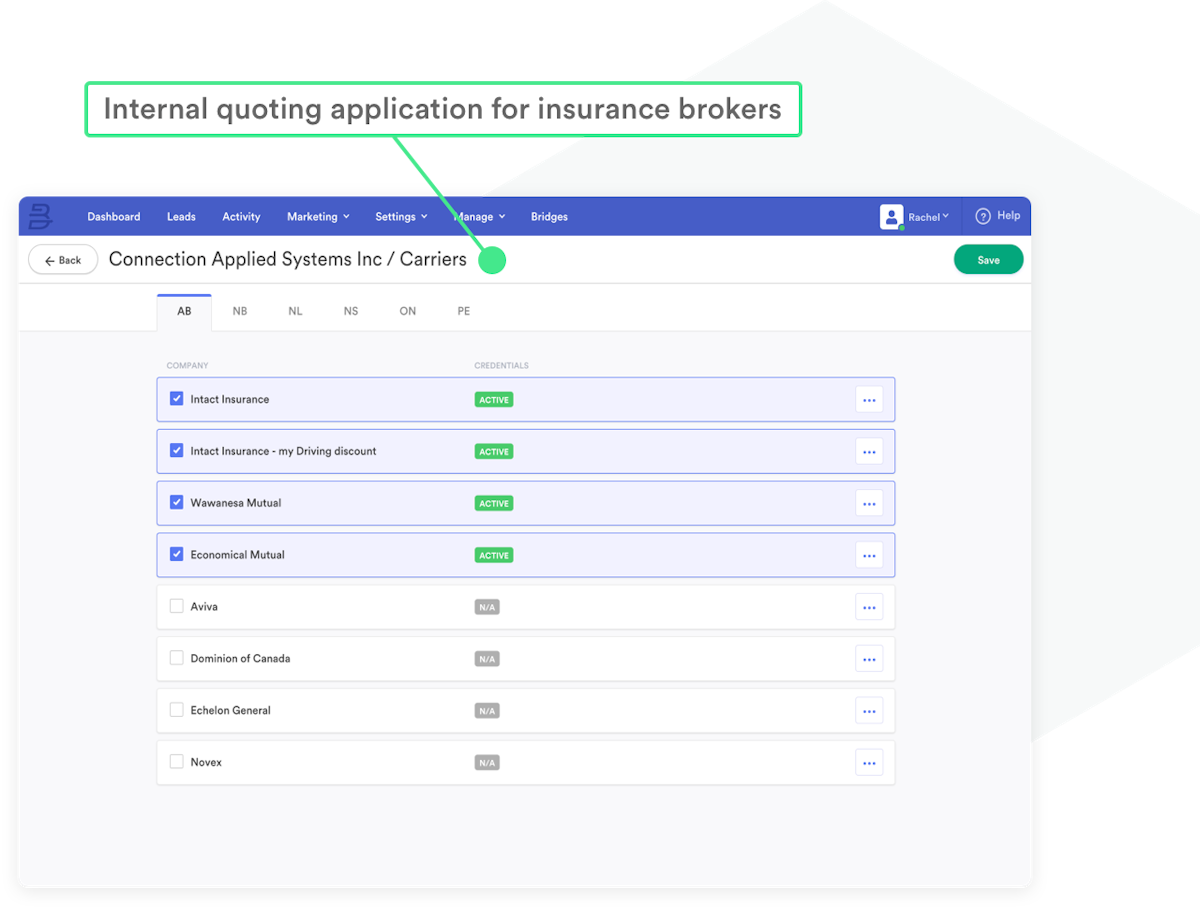

Creating a ‘data bridge’ for insurance brokers

BrokerBridge is essentially a ‘data bridge’. Brokers simply enter their credentials, and the application works like a universal adapter that connects - or bridges - their internal quoting application to external data providers. What’s more, there is no coding involved making it incredibly intuitive for brokers to use.

Making it easier to pull driving records

One of the most time-consuming tasks for brokers is pulling in driving records (MVR and Auto+) and combing through these lengthy PDFs to verify the information provided by the customer. With BrokerBridge, the MVR and Auto+ data is pulled directly into the application, eliminating the need to manually review PDFs. The interface automatically flags any issues, and if none are found, the broker can quickly move on to bind the policy.

Easily create contact records

With one click, a broker can dynamically create the customer's profile in their insurance agency management software (like Epic) with their notes and attachments. BrokerBridge integrates directly with the carrier, so the same customer information is transferred directly to them - eliminating the need to double-check the information.

The broker can then read, find, and attach the binding script to the customer’s profile, while at the same time, the customer automatically receives their temporary pink slips in PDF and Apple Wallet format.

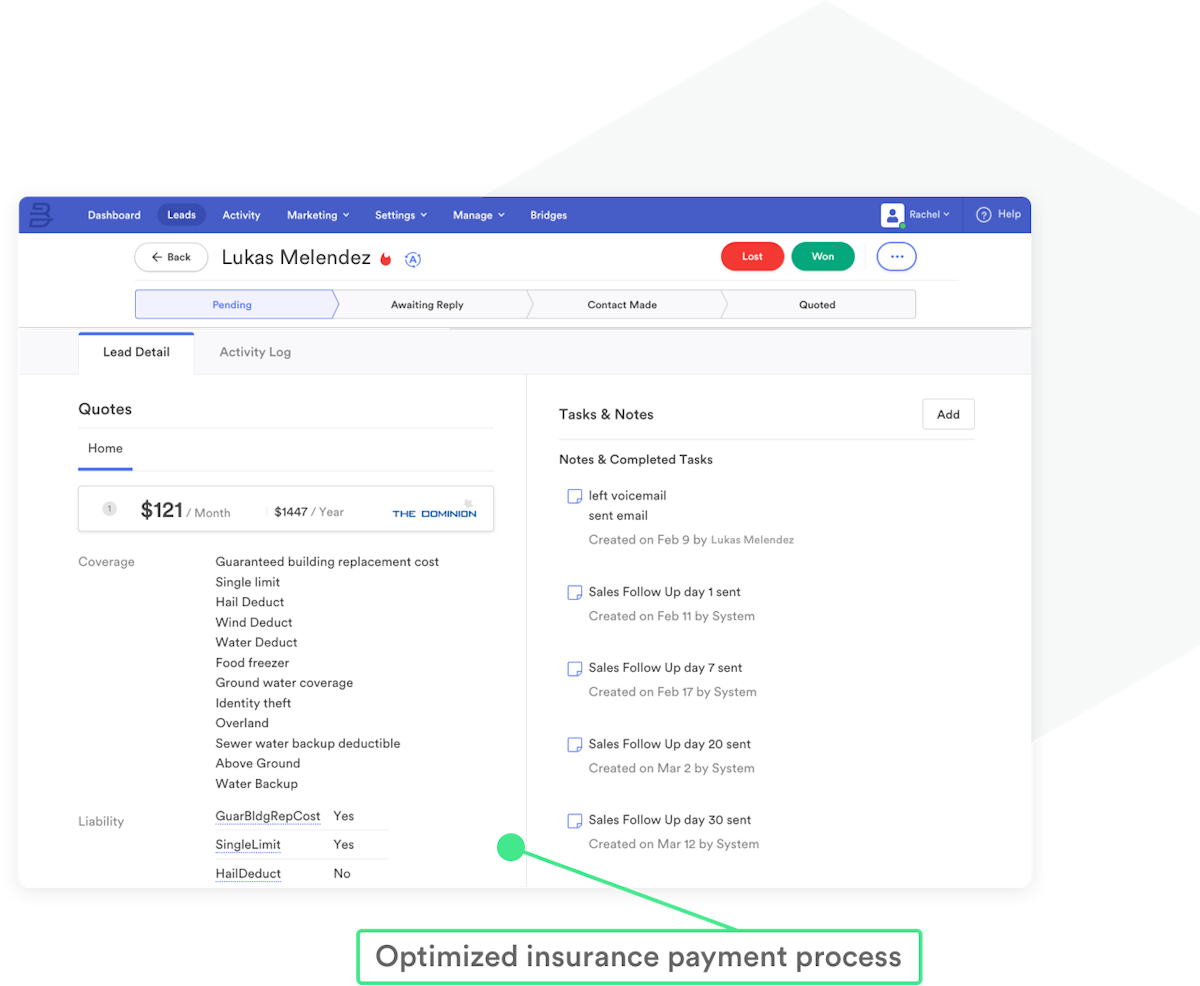

Optimizing the insurance payment process

BrokerBridge also integrates with payment providers like PayPal, Stripe, Moneris, and Kixpay to simplify the payment process for insurance brokerages. This integration streamlines the payment process and makes it easy for brokers to qualify, process and close new leads quickly.

Results

With BrokerBridge, we’ve slashed the time it takes to process an auto insurance application.

from 50 minutes to 25 minutes. on average

Delivering a sleeker insurance quotation process

With BrokerBridge, the new process for approving insurance applications was cut in half, from a dozen steps using the old method to just six with the new system. For brokers, this fresh offering often looked as simple as this:

- Easily find a customer in your system

- Review complete quote

- Push customer to insurance agency management software (like Epic)

- Read binding script

- Attach recorded binding script

- Submit application

“Wait, there’s more?” You better believe it! We also:

- Integrated with lead aggregators

- Automated the outbound sales cycle

- Made “spot checks” 3x faster for Sales Managers

- Increased the speed to find a lead

- Added Teams to lead distribution